Published on: 2 August 2024

Prime Minister Launches “GX Untuk Semua” - GXBank’s Commitment to Develop Malaysian Tech and Talent for Tomorrow’s Digital Finance Industry

●

GXBank to develop skilled talent in digital finance with RM1.5B commitment for the next 5 years●

GX Untuk Semua aligns with the government's KL20 aspirations – Prime Minister YAB Dato’ Seri Anwar Ibrahim today inaugurated GX Bank Berhad’s (GXBank) initiative, GX Untuk Semua. This initiative is a testament of GXBank's continued commitment to supporting Malaysia's nation-building and KL20 vision of being a top 20 global startup hub.

GXBank, a Grab-led digital bank, is rooted in tech and inspired by its parent company’s regional economic and social impact, and aims to lead the transformation of the digital banking and finance industry. The bank’s RM1.5 billion investment into Malaysia over the next five years includes the establishment of the GX Untuk Semua initiative, further solidifying Malaysia’s position in the digital banking landscape.

Present at the event were YB Senator Tengku Datuk Seri Utama Zafrul Tengku Abdul Aziz, Minister Of Investment, Trade And Industry of Malaysia; YB Tuan Gobind Singh Deo, Minister of Digital.

Also at the occasion were Datuk Zaiton Mohd. Hassan, Chairperson of GXBank; Anthony Tan, CEO, Co-Founder and Chairman, Grab; Pei-Si Lai, CEO, GXBank; board of directors and shareholders of GXBank; and the senior management of Grab Malaysia.

GX Untuk Semua is designed to focus on nurturing local tech talent, developing core competencies and best-in-class industry practices, and innovative solutions. This initiative will leverage the latest in technology to address financial access and sustainable solutions for the underserved. Some of the competencies and solutions that will be introduced are AI-based solutions for risk and fraud management, and personal and MSME lending solutions. Additionally, GX Untuk Semua will also encourage tech entrepreneurship and provide opportunities for tech-based solutions to be explored for tomorrow’s digital finance needs.

Datuk Zaiton Binti Mohd Hassan, Chairperson of GXBank said, ”While we are excited to introduce GX Untuk Semua, it is more than a national aspiration or a tech hub to us. It also symbolises the many big and small financial dreams of every Malaysian we hope to help fulfil. Backed by a talented workforce of more than 95% Malaysians, we are at the forefront of addressing real financial needs of every Malaysian. In fact, through our financial inclusion initiative, Impian GIGih, we have provided bursaries to 1,200 recipients in Kelantan and Johor. Therefore, with GX Untuk Semua, we hope to harness the best of our talent and innovation to ensure no one is left behind in the digital economy era.”

Rethinking Technology and Talent For Nation-Building

Companies around the world are now recalibrating their workforce to adapt with the acceleration of technology. Some have seen the opportunity to differentiate themselves by offering roles that meet employees’ upskilling and career growth needs. Gartner survey of IT executives in 2021 indicates 64% believe the ongoing tech talent shortage is the most significant barrier to the adoption of emerging technologies. Therefore, identifying and grooming the right talent is imperative for the tech industry.

GX Untuk Semua aims to help build this pipeline by cultivating that future potential through new early-career programs. In line with this, Datuk Zaiton added that the bank shaped its Impian Gigih Biasiswa to nurture local talents and work with local universities. “We look forward to sharing more about the concerted efforts under each hub in the coming months,” she further added.

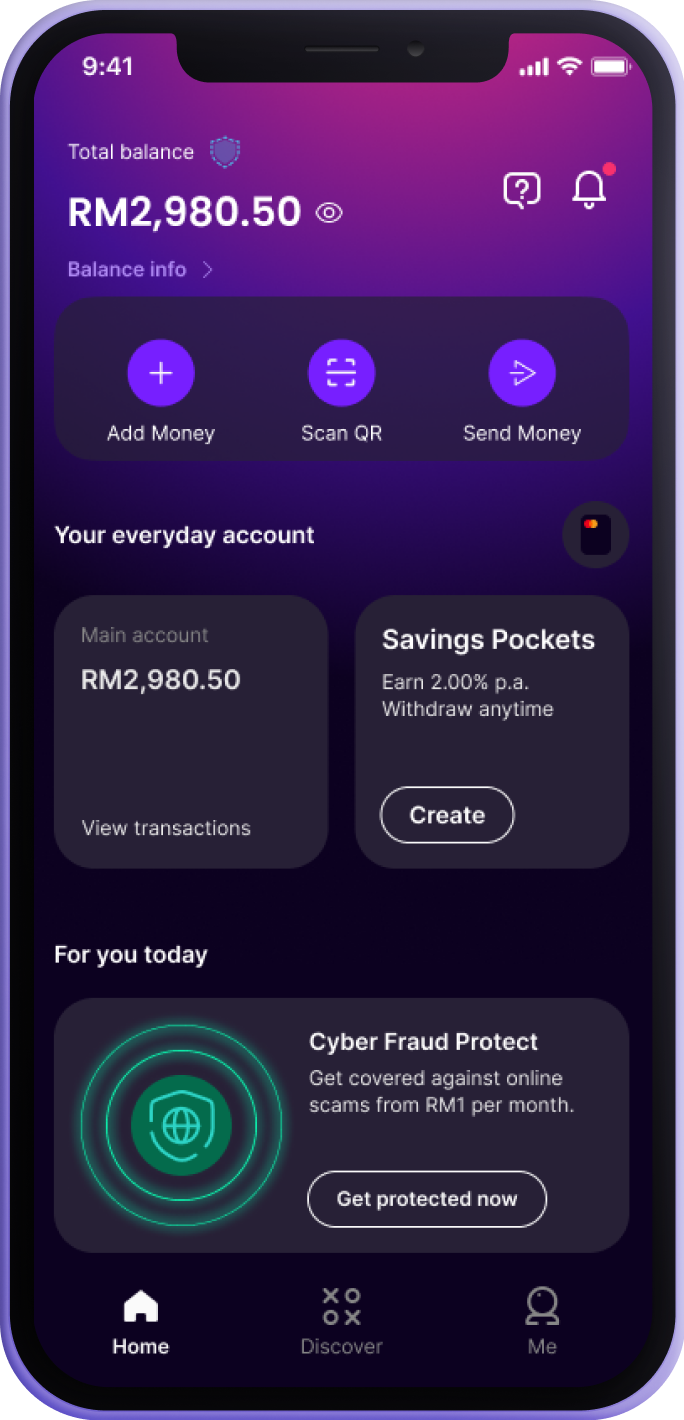

GXBank earned the trust and support of 100,000 users within its first two weeks of debut in November 2023. By the end of July 2024, it amassed more than 1,000,000 customers, who have set up more than 800,000 Savings Pockets. In turn, these customers have conducted more than 13 million transactions collectively via GX Card and QR code. The growth signifies Malaysians’ preference for digitalisation of banking services during this era and their trust in digital banking.