Personal Banking

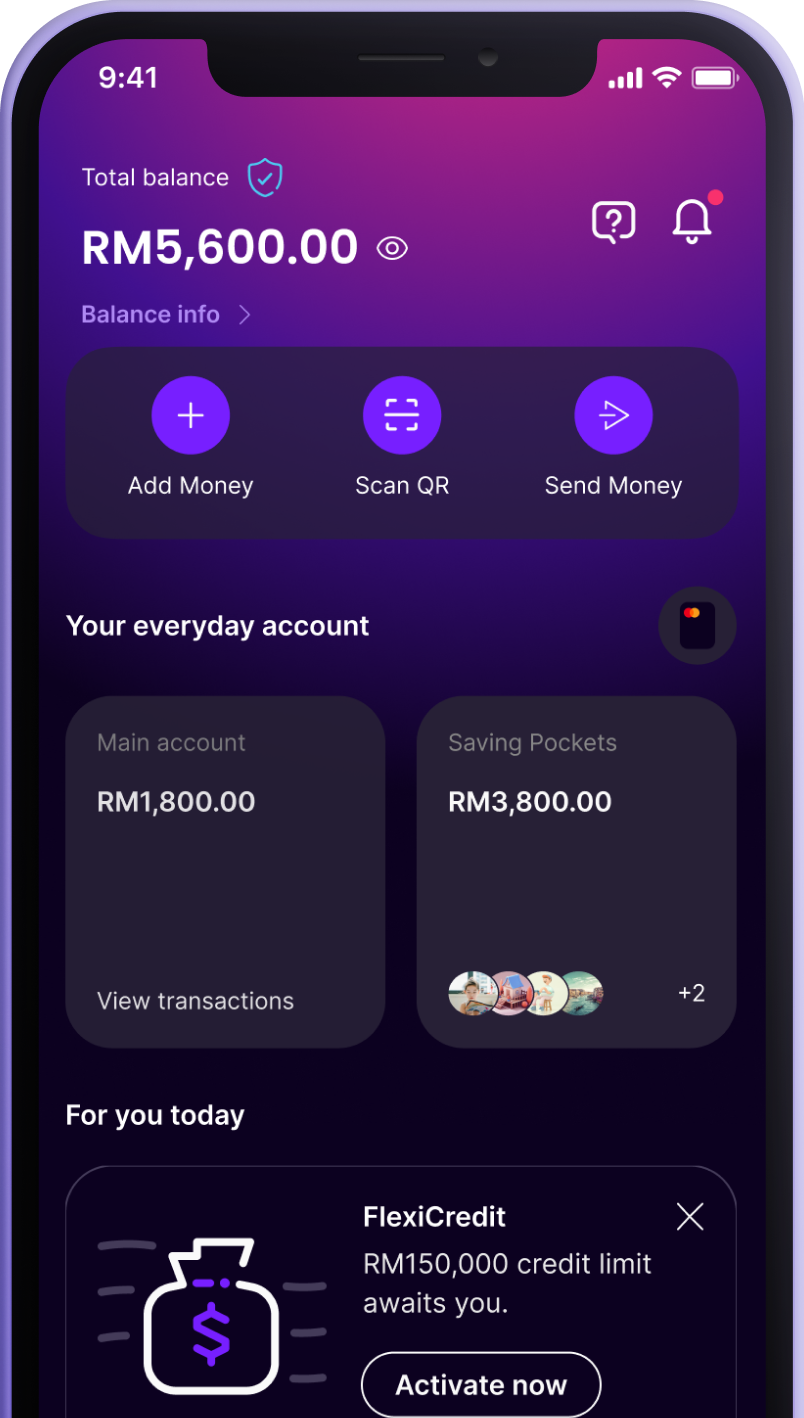

Save

Personal Banking

Savings Account

Bonus Pocket

Spend

Debit Card

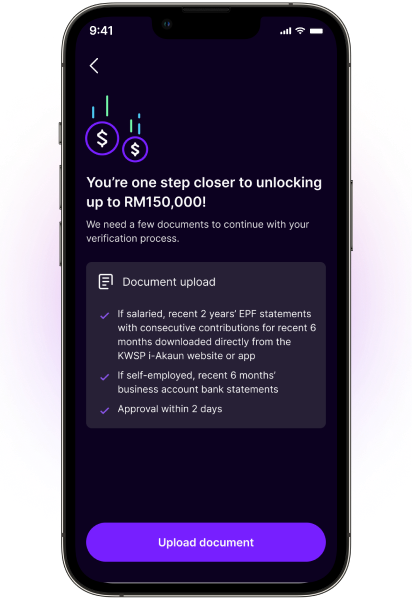

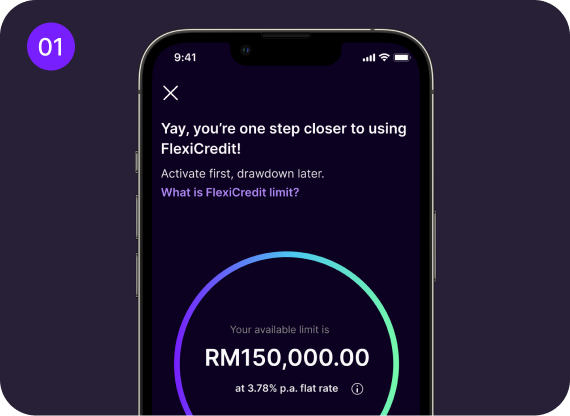

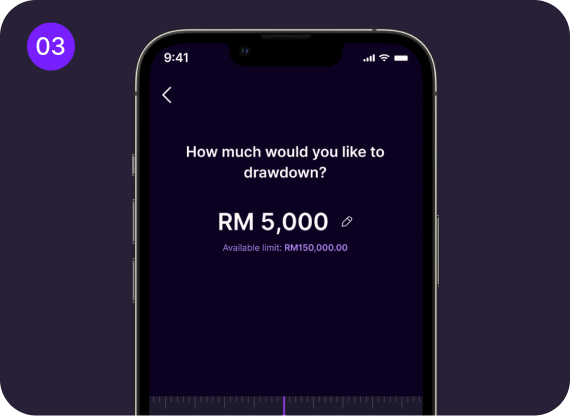

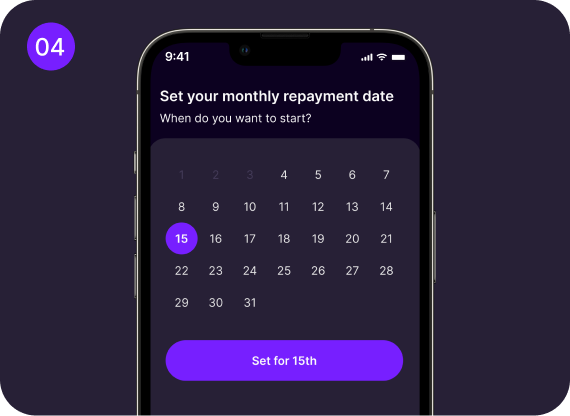

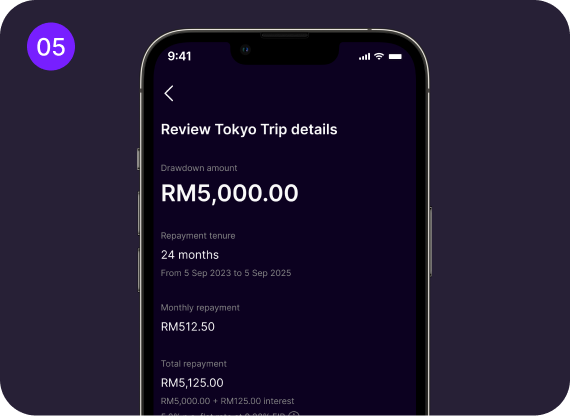

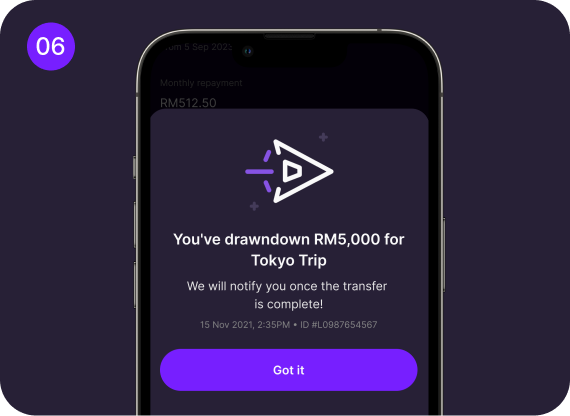

Borrow

FlexiCredit

Insure

Cyber Fraud Protect

Car Insurance

Travel Insurance

Experience

Campaign

Rewards

Business

Business Banking

Biz Account

Biz FlexiLoan

Campaign

Features

Our App

Banking Feature

Security

How We Protect Your Money

Anti-Malware

About Us

Who We Are?

About Us

The Digibank Story

Our Leadership

Careers

What’s New?

Newsroom

Awards

We Give Back

Impian Gigih

TeXnovasi

Jaguh Niaga