IMPORTANT: GXBank does not appoint any third-party agents or internal agents. For your protection, all official services are conducted ONLY through our app, downloaded from the Apple App Store and Google Play Store. If you are unsure, please contact our 24/7 support immediately.

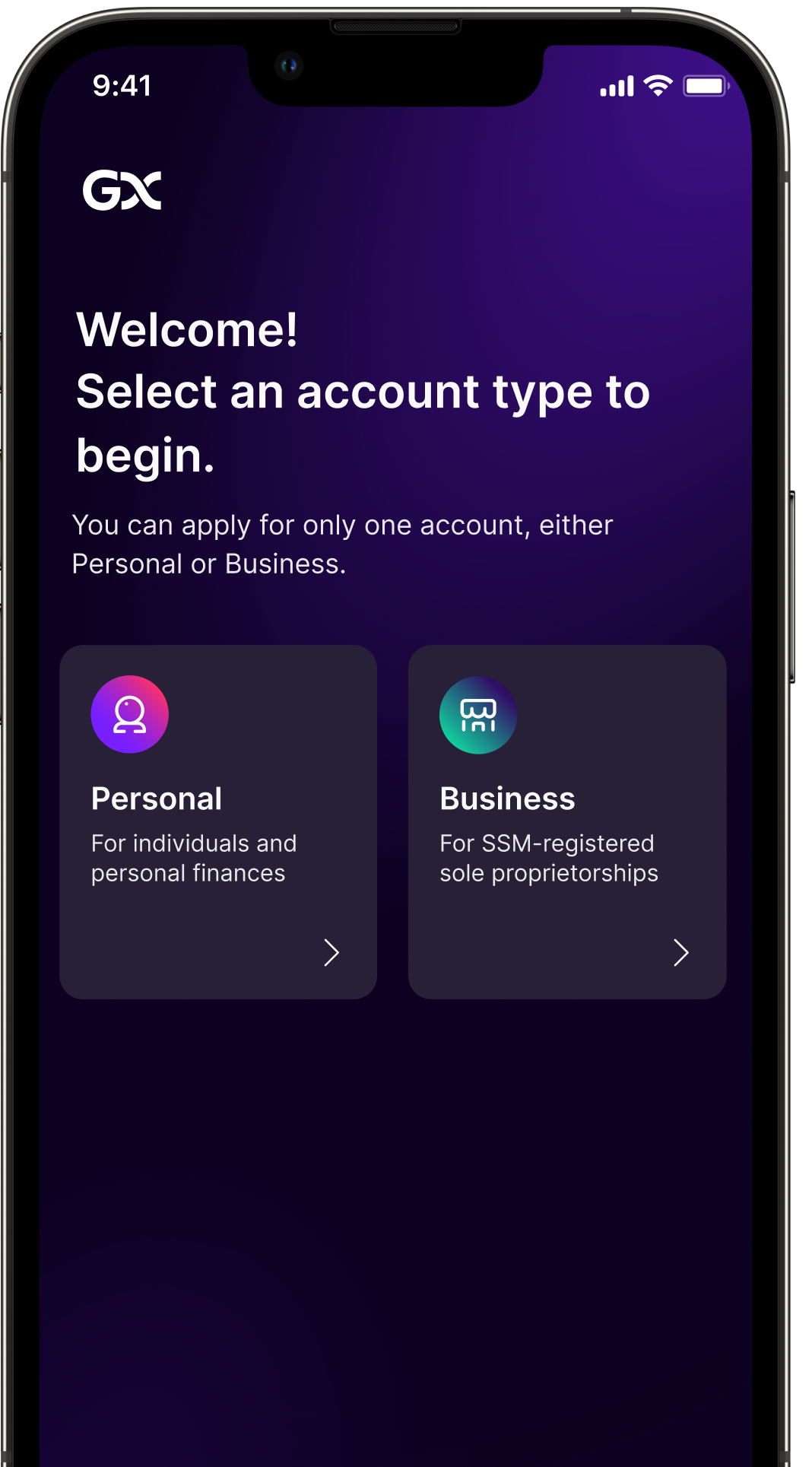

Personal

Save

Personal Banking

Savings Account

Bonus Pocket

Spend

Debit Card

Borrow

FlexiCredit

Insure

Cyber Fraud Protect

Car Insurance

Travel Insurance

Experience

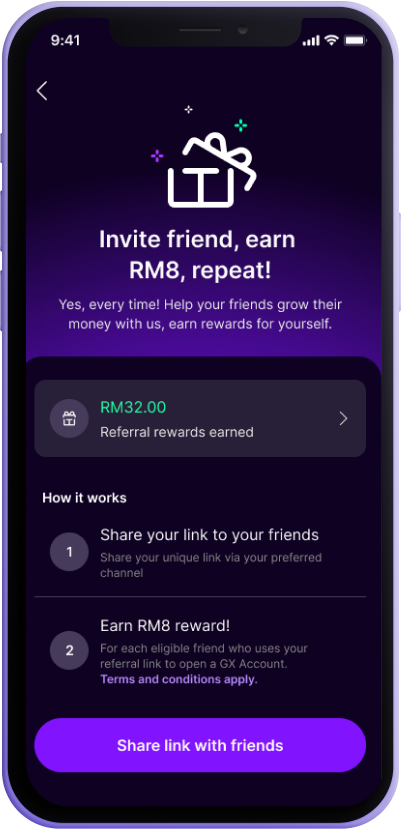

Campaign

Rewards

Business

Business Banking

Biz Account

Biz FlexiLoan

Campaign

Features

Our App

Banking Feature

Security

How We Protect Your Money

Anti-Malware

About Us

Who We Are?

About Us

The Digibank Story

Our Leadership

Careers

What’s New?

Newsroom

Awards

We Give Back

Impian Gigih

TeXnovasi

Jaguh Niaga